Payday loans are extremely helpful during a temporary cash crunch. They offer speedy and convenient application procedure and instant loan approvals, which help you meet your financial needs during emergencies. While this feature of speed and convenience in payday loans is lauded by many, it’s very important for you to know what you are getting into before applying for these instant cash advance loans.

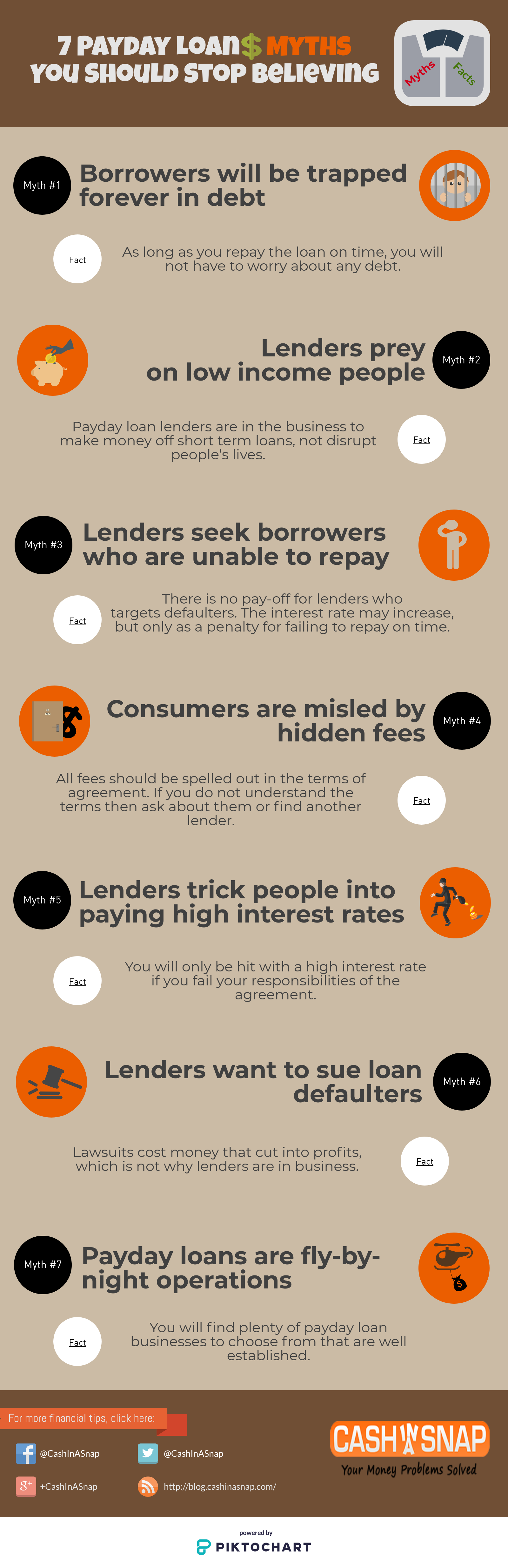

We’ve created an infographic that will help you know the facts behind the most common payday loan myths.

Payday loans can be very helpful in emergencies, but they can also be very costly if you do not treat them responsibly. Unlike conventional bank loans, payday loans need to be paid back right away or the interest rate will skyrocket. Americans are attracted to the no hassle and fast cash aspects of this type of lending, but it is very important for borrowers to know what they are getting into before applying.

Here are some popular myths about payday loans

Borrowers will be trapped forever in debt

As long as you repay the loan on time, you will not have to worry about any debt. Most payday loans must be repaid within two to four weeks.

Lenders prey on low income people

Payday loan lenders are in the business to make money off short term loans, not disrupt people's lives. They would lose money if all they attracted were poor borrowers.

Lenders seek borrowers who are unable to repay

There is no pay-off for a lender who targets people that default. The interest rate may increase, but only as a penalty for failing to repay on time.

Consumers are misled by hidden fees

All fees should be spelled out in the terms of agreement. If you do not understand the terms then ask about them or find another lender.

Payday loans are designed to trick people into paying high interest rates

You will only be hit with a high interest rate if you fail your responsibilities of the agreement.

The goal of lenders is to sue borrowers if they cannot repay loans on time

Lawsuits cost money that cut into profits, which is not why lenders are in business.

Payday loans are fly-by-night operations

You will find plenty of payday loan businesses to choose from that are well established.